Gain Critical Insight to ESG Risk on Your Business

Improve ESG Risk Mitigation with Critical Impact Visualization

Create Your Personalized Dashboard-Free Risk Assessment

Convert cyber-uncertainty into cyber intelligence In near-real time

ESG Risk Assessment

Environmental – Social – Governance

Integrating ESG objectives into your enterprise risk program helps reduce your operations’ Greenhouse Gas emissions; understand the impact on your supply chain; and maintains sound governance.

Define and monitor transitions to a low carbon economy with our AI/ML driven ESG risk management analytics.

Assess and Reduce Your ESG Risk

Perform ESG Risk Assessment

AI/ML Powered Risk Models

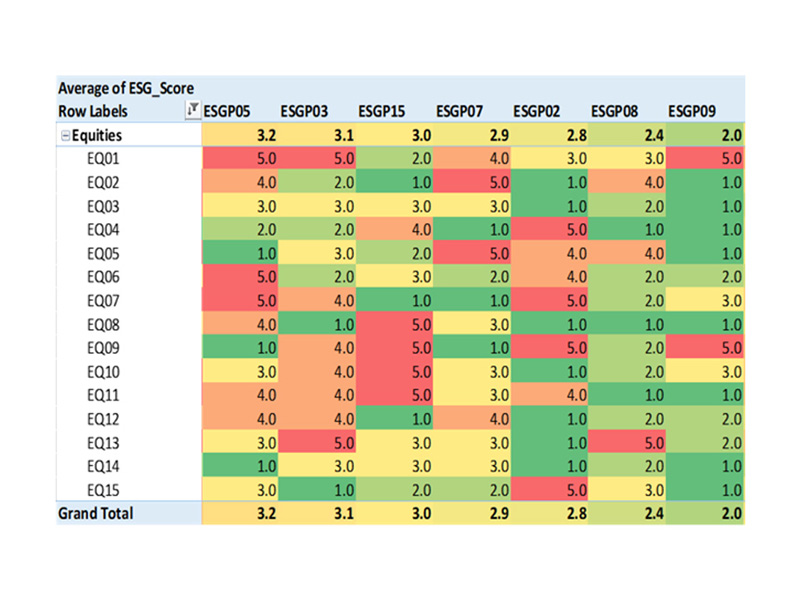

ESG Risk Reporting requires assessing ESG risk from a variety of perspectives – that of Regulator, Investor, Consumer and Supplier.

RiskOpsAI™ Risk modeling leverages the power of AI in mapping vulnerabilities across hundreds of controls drawn from ISO Standards, SEC Regulations, TCFD Reporting Framework, GHG Protocol and Industry Best Practices in generating the ESG Risk Assessment specific to your industry and size clearly quantifying the ESG Risk $ and impact to your business goals.

Perform ESG Risk Assessments

AI/ML Powered Risk Models

ESG Risk Reporting requires assessing ESG risk from a variety of perspectives – that of Regulator, Investor, Consumer and Supplier.

RiskOpsAI™ Risk modeling leverages the power of AI in mapping vulnerabilities across hundreds of controls drawn from ISO Standards, SEC Regulations, TCFD Reporting Framework, GHG Protocol and Industry Best Practices in generating the ESG Risk Assessment specific to your industry and size clearly quantifying the ESG Risk $ and impact to your business goals.

Target Multiple Use Cases

Highly Customizable and Configurable Platform

Our highly flexible and adaptable risk architecture allows you to generate ESG Risk profile for a diverse set of use cases such as mapping your carbon footprint, tracking your transition risk, predicting the impact of a climate event on your physical assets or quantifying the ESG exposure on your investment portfolio.

Some of the other potential use cases include establishing the sustainability of your supply chain, ranking your Third Parties on ESG Standards, assessing the sustainability of your investment, credit or mortgage portfolio, generating compliance reports towards ESG Disclosures

Simulate Diverse Risk Scenarios

Control Effectiveness Measurements

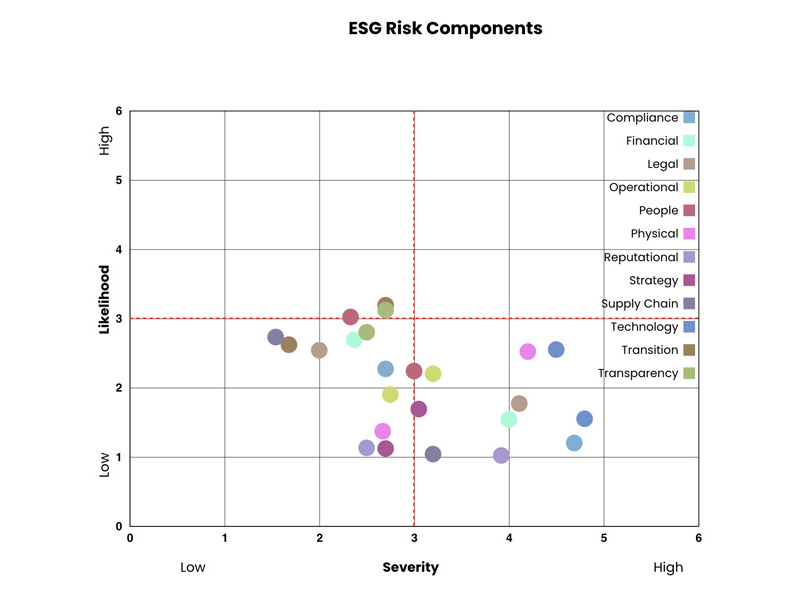

RiskOpsAI™ platform presents a profile of your top vulnerabilities, sources of risk and list of underlying controls that need to be monitored regularly.

The highly intuitive and interactive Risk Scenario Planner allows you to measure and vary the effectiveness of each control to discover your top ESG risks across multiple risk scenarios. The platform allows you to configure the threshold for each control, as per your risk appetite, threat perception and relative industry benchmark.

Simulate Diverse Risk Scenarios

Control Effectiveness Measurements

RiskOpsAI™ platform presents a profile of your top vulnerabilities, sources of risk and list of underlying controls that need to be monitored regularly.

The highly intuitive and interactive Risk Scenario Planner allows you to measure and vary the effectiveness of each control to discover your top ESG risks across multiple risk scenarios. The platform allows you to configure the threshold for each control, as per your risk appetite, threat perception and relative industry benchmark.

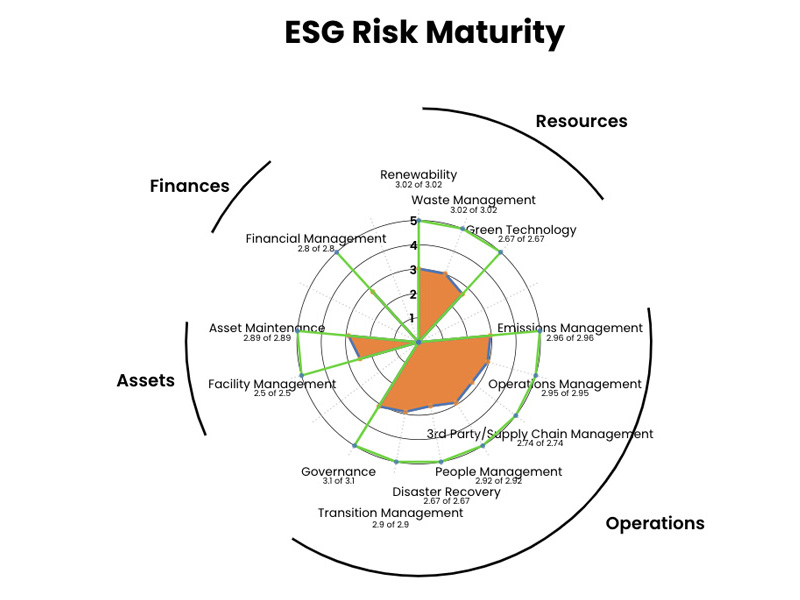

Benchmark Your ESG Risk

ESG Risk Maturity Snapshots

RiskOpsAI™ uses AI to model your ESG risk and benchmark it with respect to your industry, geography and scale.

Our ESG Maturity Framework helps businesses better understand, manage, and monitor their ESG Risk across multiple dimensions such as Assets, Finances, Resources and Operations with respect to their Emission Levels, Community Engagement, Land and Natural Resource Usage, Energy Management, Asset & Facility Maintenance, Green Technology, Circularity and recyclability to name a few.

Explore Our Other Risk Models

Cyber Risk

Data Privacy

Compliance

See for Yourself

Discover how leading brands are using RiskOpsAI™ to achieve business goals with our Risk Visualization Platform

Cannot collect videos from this channel. Please make sure this is a valid channel ID.